Welcome to the 3 people reading this "yet another newsletter 🙄". I know this is a 102457th new newsletter post-COVID. But I thought I'd start this newsletter precisely for that reason. There's been an insane explosion in new newsletters, blogs and Twitter accounts that are publishing some amazing insights about markets at large. And most of it free and a lot of this content goes unnoticed.

And moreover, traditional financial media is just filled with garbage and there's no point in relying on it. I hardly spend 10-15 mins a day on the traditional outlets like Moneycontrol, ET etc. I've pretty much replaced my financial news diet with newsletters and blogs.

Given the sheer abundance of amazing content, I think we need a newsletter of newsletters. And hopefully, this is that. Given that all these smart people share their insights freely, this newsletter is my way of also thanking them by highlighting their efforts. So, here's the first edition of Moneyshot.

Nonstop games

Unless you've been living under a rock, there's no chance you would have missed the insane Michael Bay, Ram Gopal Verma movie-level drama surrounding the epic short squeeze in GameStop. I don't want to bore you with another article on what or why this is happening, there are some really good articles out there. But what's really interesting is how narratives are created around this craziness in real-time and how those narratives are driving the markets.

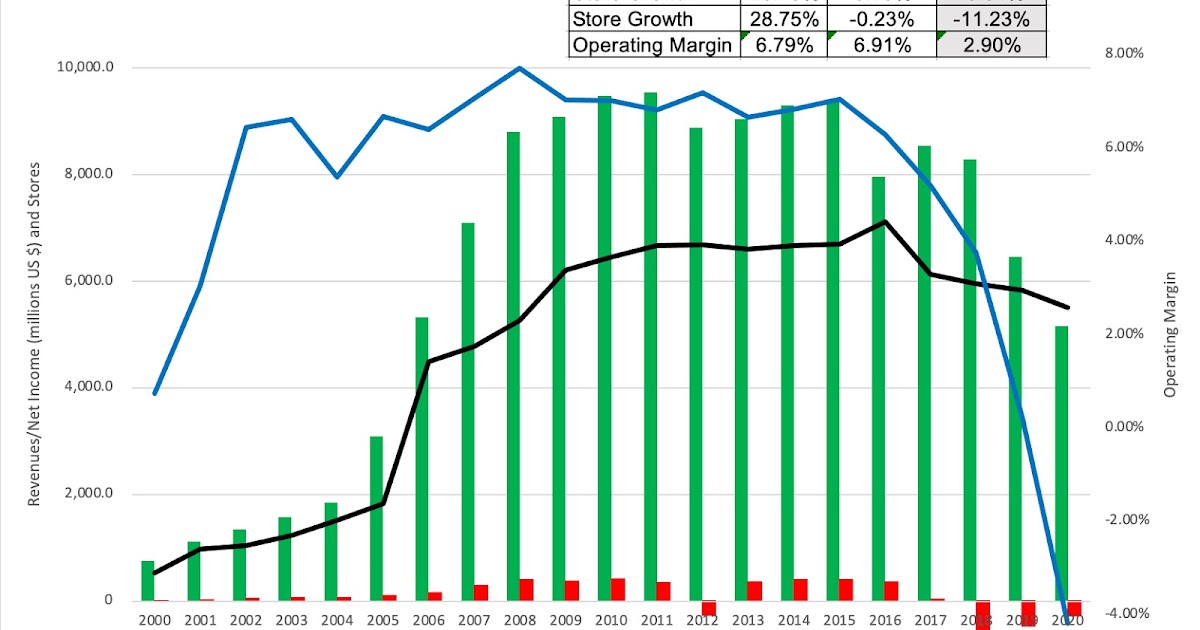

But assuming that you're one of those rare people who does live under a rock, here's an oversimplified quick summary. GameStop is a dying retail chain with over 5000 stores across the US that sells games and gaming hardware and gaming merchandise. The company has been in trouble for a long time as humans starting moving online.

Sometime in 2019, Michael Burry, who was immortalized by Christian Bale in the movie The Big Short, picked up a ~5% stake in the company. Over a period of time, he reduced it and currently holds about 2.6%

In September 2019, Ryan Cohen, the founder of Chewy picks up a 10% stake and later increases it to 12.9%.

Around this time, people start talking about the stock on r/WallStreetBets (WSB) Reddit forum and the Discord channel. WSB is best-described as a forum full of people who take ridiculous stock market gambles like buying deep OTM calls, going all-in on penny stocks with their entire savings and so on for fun.

The pandemic forces people to work from home. In a span of few months, online brokers like Robinhood, Webull, Schwab, TD etc. add millions of new users, predominantly young people. Users on WSB spike from about 800,000 users to 6 million users.

Stock market becomes entertainment for an entire generation of first-time investors, many of whom end up on WSB. These people band together and start buying penny stocks companies in a coordinated manner quite literally start moving stocks.

The forum grows rapidly and morphs into something else. The initial creator loses control and gets kicked out.

GameStop becomes the target of short-sellers, most notably Melvin Capital and Citron Research. WSB decides to teach the shorts a lesson and start piling to GameStop by buying the stocks and call options.

Unlike India, you have market makers and dealers in F&O. So when a market maker is on the other side of a trade, he has to hedge it. With this insane explosion in buying of calls, the markets makers had to buy the underlying stock to hedge which starts pushing the price of the stock up. This is an oversimplified explanation and there are a lot of nuances.

This creates ab upward momentum in the stock and momentum begets momentum. More buyers, algos pile on into the stock feeding on the trend.

The stock goes vertical. Now, remember the short sellers? They were buggered. As the stock went higher and higher they had to post higher collateral to cover the losses and Melvin capital had to borrow $2.75 billion from Ken Griffin. Several hedge funds bleeding from the losses unwind their shorts.

Like I said earlier, momentum begets momentum. The craziness and all media attention to WSB draws millions of new members and the craziness continues. All the major brokers like Robinhood, Webull, TD Ameritrade restrict buying the stock because the collateral they had posted with the clearinghouses weren't enough given the insane volatility in the stock. Just take a look at this intraday chart and the price levels.

This whole saga was so captivating that politicians like Alexandria Ocasio-Cortez, Ted Cruz, Elizabeth Warren, Bernie Sanders and other district attorneys start screaming murder and rail against Wall Street.

Crap, I thought, I could keep this short but anyways, this is the quick summary. There are plenty of pieces like these pieces [1,2,3] by Matt Levine which look at this drama in far more detail.

Narrative violations

Like Robert Shiller's work has shown us, narratives and stories influence stocks, markets and economies. We are evolutionarily hardwired to relate to stories. The hatred you feel towards a villain, the chill down your spine when the protagonist heroically triumphs adversity and defeats the villain, the butterflies in your stomach when the boy finally gets the girl. We are all suckers for a good story. In fact, stories are so powerful they evoke biological reactions in us, stories are very much physical as they are mental.

We fall for stories more than we think so. Tesla is a case in point, it's a textbook example of a story stock. If you look at the fundamentals of Tesla it's very hard to justify the price, but stories eat facts for lunch any given day.

As someone who uses a simple trend following strategies to trade and invest, I've been fascinated by stories and narratives. Because they are my bread and butter. Stories, in my view, play a far bigger role in creating trends and momentum in the markets then we believe.

And this whole GameStop thing is a fascinating demonstration of how viral narratives were created and are still being created that are having an outsized impact on various parts of the markets. And it's also a bit annoying to see how the stupidest narratives have spread the most. So this post is also an attempt to get all this frustration out of my system so please bear with me.

So, here are some of the most astoundingly nonsensical narrative that has spread the most.

WallStreetBets yoloers are moving GameStop

No! If you think a bunch of bored teens with nothing better to caused this insane spike in volumes, then you must be smoking some adulterated local maal. This is as much professionals as Reditters. Sure, these people might be part of the cause of the move. But without other professionals riding this thing, you don't get a single day traded volume of $32 billion. Retail investors, even those who've lost their minds aren't that big.

For every hedge fund like Melvin which lost money, plenty of other funds would've made a killing. When there is such strong momentum, algos that feed on momentum.

It's kind of romantic to think that an organized bunch of retailers hold such sway over stocks, but that's just nonsense. Such David vs goliath headlines appeal to our "little guy' emotions and the media churns them out. But it makes no bloody sense.

Little guys vs Wall Street

David vs Goliath

Rage against the machine

Neo occupy Wall Street

The next narrative was that this was somehow of a revolt of retail investors against the greedy Wall Street machine. The virtuous retail investors slaying greedy Wall Street beasts. David finally kicking goliath in the ...! Journalists, politicians and other people started hyperventilating with catchy headlines and tweets. Here are a few

This is perhaps the most absurd narrative to have come out of this saga. I think this is a result of the deep-seated hatred that pretty much most Americans have toward Wall Street especially after everybody got away clean after 2008. But to paint a bunch of bored nutjobs who want to gamble away their life savings on junk stocks as the new Occupy Wall Street movement is just stupid.

Let's be perfectly clear, WSB isn't an organized revolt against Wall Street. This narrative was made created by the financial media because it is so damn powerful and romantic. An underdog story always sells. And this is just that a concocted narrative for clicks and nothing more. A good number of people WallStreetBets are bored racist and homophobic white dudes gambling with their money. Most of these will be unwitting plebs who are getting swept away by the narratives who have zero clue what they are doing. This is one of those rare time being absolutely wrong and stupid makes money.

And there will be plenty of people from Wall Street itself who would be egging these people on WSB and making money at it. Don't underestimate the power of Wall Street insiders, they're not all empty overpaid suits. They're are a cunning bunch and they've been playing this game since most of the idiots on WSB were in their smelly diapers.

Giving this circus a revolutionary tinge will just encourage these people to carry on with the craziness and gamble their money away. The media will egg these people on so that they can milk this for all its worth.

But at the end of the day, you have to realize that there is real money at stake here. Even of 20% of the stories on WSB are true, these people are gambling with their retirement savings and worse yet, that of their family members.

When this circus ends, the hedge funds will be alright. The media will move on to another story and the politicians will politic something else. But the chumps will most definitely

This can end only in one way, with the chumps losing their money.

Hidden agendas

The other disturbing thing in those whole sordid mess was that billionaires like Elon Musk and Chamath were cheering on the mindless mob. These guys preach virutues but they have their own fucking agendas they'll come out alright

Elon, for example, has had a longheld vendetta against short sellers who believe that Tesla is just a massive fraud.

Didn't Chamath make most of his money at Facebook?

Narrative deception. If retail investors were so smart, things would've been far different in this world. They'll always be roadkill for the hedgies.

Write a comment ...